Is your business aware of this unique tax saving opportunity?

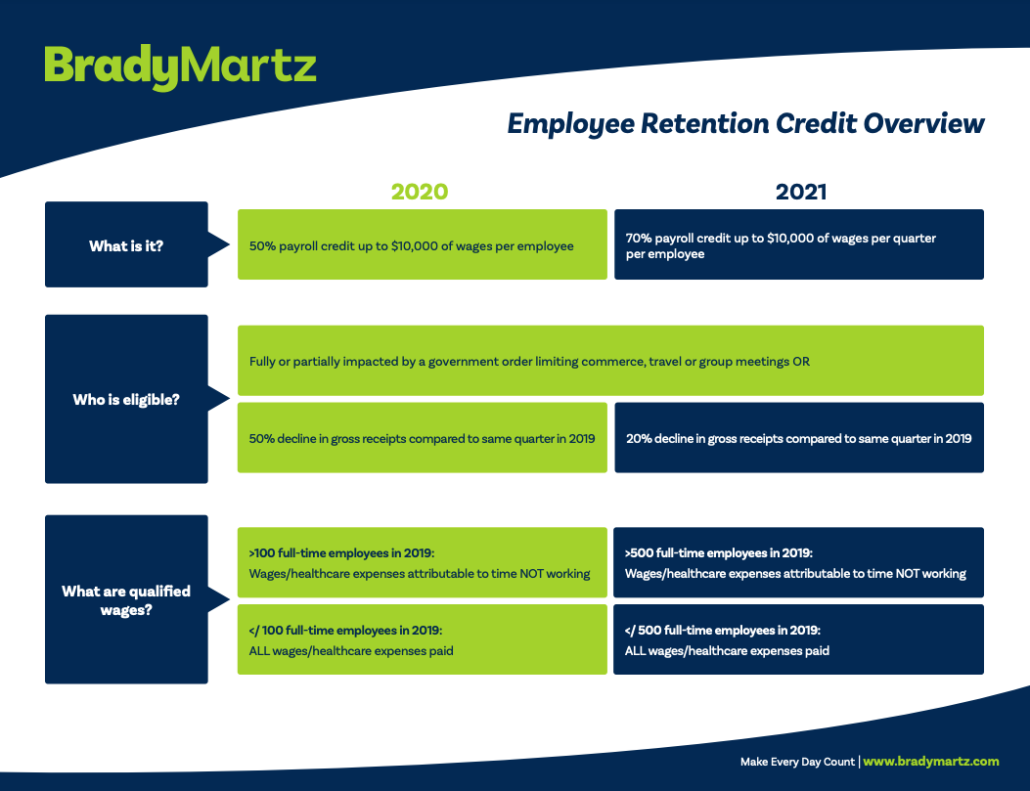

The Employee Retention Tax Credit (ERTC) changes put into play in December allow companies who meet certain qualifications to receive a refund on their payroll taxes, even if you were given a Paycheck Protection Program (PPP) loan.

You may qualify if:

- Your 2021 gross receipts have declined by more than 20%

- Q1 2021 over Q1 2019 and/or Q2 2021 over Q2 2019

- Your 2020 gross receipts declined by more than 50% in any quarter compared to the same quarter in 2019.

- You experienced partial of full shut-downs due to governmental restrictions, you may also qualify.

Click the image below to expand the overview.

Brady Martz has a team of professionals dedicated to help you maximize this credit. Our qualified team will calculate your estimated tax credit and our fees will be communicated up front. Should you decide to pursue your tax credit the initial work up will be done at no charge. If you elect to not move forward, we will charge a nominal fee for the estimate you receive.

We will guide you through collecting the information needed to calculate the credit and file all required forms and returns for you. In addition, we can help sort out the overlapping wage issues with the PPP/ERTC and WOTC to avoid double-dipping, which is the most challenging of all. We will even help you determine if you can qualify retroactively for ERTC for 2020 even if you’ve taken the PPP loan.

Don’t miss this opportunity to take advantage of these payroll tax credits. If you are ready to get started or just learn more, please click here (link to email address from newsletter) to contact our team of experts.