After several months of the Republicans and Democrats not being able to agree on additional COVID-related tax relief and other matters, as 2020 was coming to an end, horses were traded, and deals were made so that Congress could put together the much-needed legislation. The result is a nearly 5,600-page omnibus bill, the Consolidated Appropriations Act, 2021, Included in that legislation are the “COVID-Related Tax Relief Act of 2020” (COVIDTRA) and the “Taxpayer Certainty and Disaster Tax Relief Act of 2020”. The bill was signed by the President on December 27.

This article provides an overview of the many tax provisions included in the legislation, including the 2nd round of economic impact payments, another round of targeted PPP loans for businesses, favorable tax treatment of expenses paid with forgiven loan proceeds, temporary expanded deduction for business meals, and modifications to charitable contributions—along with an excess of 30 new, altered, and extended tax provisions.

Additional 2020 Recovery Rebates

An additional round of economic impact payments (EIPs) is included in the legislation but the amount is substantially less than the first round, which was $1,200 per eligible adult and $500 per dependent child under age 17. This new round will be $600 per eligible adult and $600 per dependent child under 17. Also, eligible this time are the so-called mixed-status households, for example where one of the spouses is a noncitizen, which were previously excluded from receiving payments.

Maximum Payment Amounts:

- Each eligible adult: $600

- Married couple (both eligible) filing jointly: $1,200

- Each dependent child under age 17: $600

Payment Phaseout – The payment is phased out by 5% of the taxpayer’s 2019 AGI that exceeds the filing status threshold.

| CREDIT PHASEOUT THRESHOLD |

| Filing Status |

Threshold |

| Unmarried Taxpayers (as well as Married Filing Separately) |

$75,000 |

| Head of Household |

$112,500 |

| Married Taxpayers Filing Joint & SS |

$150,000 |

Payment Due Date – Although the Act includes a January 15, 2021 deadline for advance payments to be made, President Trump’s delay in signing the bill may delay the payments.

No Social Security Number – In general, taxpayers without an eligible Social Security number are not eligible for the payment. However, married taxpayers filing jointly, and otherwise eligible, where one spouse has a Social Security Number and one spouse does not are eligible for a payment of $600, in addition to $600 per child under age 17 with a Social Security Number.

Deceased Taxpayers – There was considerable confusion related to the first round when the IRS issued EIPs to deceased individuals. This time around they have specified that anyone that was deceased before January 1, 2020 is not eligible for an EIP.

The payments will be treated as a refundable 2020 tax credit and reconciled to the correct amount on the 2020 return. Any excess payment will not be required to be repaid and if the payment was less than qualified for, the difference will be paid as a refundable credit when the 2020 return is filed.

Paycheck Protection Program (PPP) Loans & Small Business Support

The legislation includes over $300 billion for first and second forgivable PPP loans. Unlike the prior loan program, this round will truly be limited to small businesses that incurred a loss of revenue. Eligibility is limited to:

- Businesses with 300 or fewer employees that have sustained a 25% revenue loss in any quarter of 2020 as compared with the same period in 2019.

- Small 501(c)(6) organizations that are not lobbying organizations and that have 150 employees or fewer, such as local chambers of commerce, economic development organizations, and tourism offices.

- Certain 501(c)(6) nonprofits and Destination Marketing Organizations with 300 or fewer employees that do not receive more than 15 percent of their revenue from lobbying.

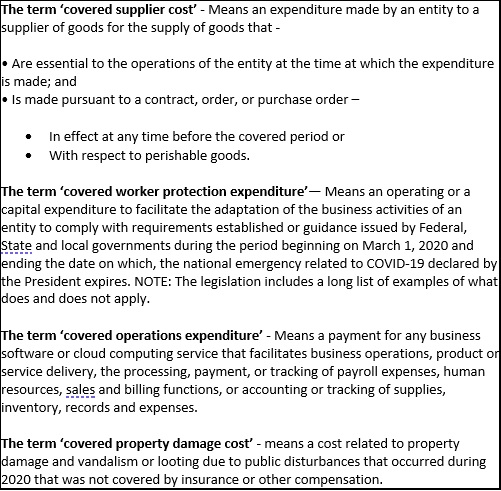

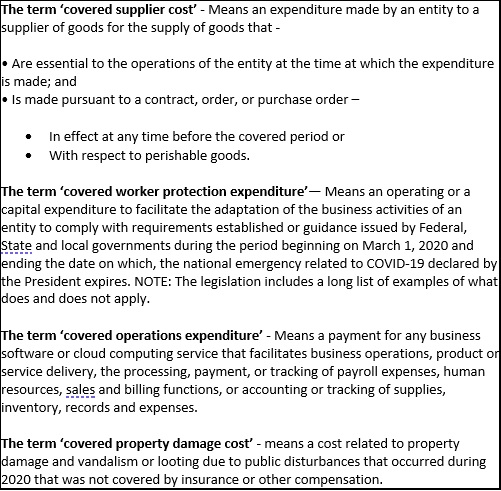

- Local newspapers and T.V. and radio stations previously made ineligible by their affiliation with other stations. Forgivable Expenses – will be expanded to include covered (COVIDTRA Sec 304):

- Payroll costs – Including additional group insurance payments, including vision, dental, disability and life insurance.

- Operational Costs

- Property Damage Costs

- Supplier costs on existing contracts and purchase orders, including the cost for perishable goods at any time.

- Investments in facility modifications and personal protective equipment needed to operate safely and technology operations expenditures.

Loan Size – Establishes a maximum loan size of 2.5 times the average monthly payroll costs, up to $2 million.

- Allows small businesses assigned to the industry NAICS code 72 (Accommodation and Food Services) to receive PPP second draw loans equal to 3.5 times their average monthly payroll costs in order to help these businesses combat onerous State and local restrictions.

- Maintains existing expansions in eligibility for businesses assigned to the industry NAICS code 72 (Accommodation and Food Services).

Loan Forgiveness – Full loan forgiveness is available if the borrower spends at least 60% of the second draw on payroll costs over either an 8-week or 24-week period selected by the borrower.

Simplified Loan Forgiveness – The loan forgiveness process is simplified for borrowers with PPP loans of $150,000 or less. (This means another version of the SBA’s loan forgiveness application form will be forthcoming.)

Churches and Religious Organizations – Are eligible for loans and prevents future administrations from making them ineligible.

Planned Parenthood – Is ineligible

Set-Asides – $41 billion is set aside to ensure that smaller borrowers and under-served communities get the help they need, such as:

- Small businesses with 10 or fewer employees,

- Small community lenders,

- Independent live venue operators, including eligible independent movie theaters and museums, affected by COVID-19 stay-at-home orders.

Clarification of Tax Treatment of Covered Loan Forgiveness Expenses

The CARES Act provides that a recipient of a PPP loan may use the loan proceeds to pay payroll costs, certain employee benefits relating to healthcare, interest on mortgage obligations, rent, utilities, and interest on any other existing debt obligations. If a PPP loan recipient uses their PPP loan to pay those costs, they can have their loan forgiven in an amount equal to those costs. PPP loan forgiveness doesn’t give rise to taxable income and the Code generally doesn’t allow a taxpayer to deduct expenses that are paid with tax exempt income.

The IRS had issued a ruling essentially saying that since businesses aren’t taxed on the proceeds of a forgiven PPP loan, the expenses aren’t deductible. However, members of Congress have been saying all along that was not the Congressional intent.

In a rebuttal to the IRS, Congress made it crystal clear in the Act that taxpayers whose PPP loans are forgiven are allowed deductions for otherwise deductible expenses paid with the proceeds of a PPP loan, and that the tax basis and other attributes of the borrower’s assets will not be reduced as a result of the loan forgiveness.

Business Meals

The Tax Cuts and Jobs Act of 2017 (TCJA) eliminated the deduction for entertainment and curtailed the expense deduction for meals. In a very business friendly transitional guidance (Notice 2018-76) on the deductibility of business meals, the IRS announced that taxpayers generally may continue to deduct the food and beverage expenses associated with operating their trade or business. Under this notice, taxpayers may deduct 50% of an otherwise allowable business meal expense.

Under Sec 210 of the Taxpayer Certainty and Disaster Tax Relief Act of 2020, for 2021 and 2022, taxpayers will be able to deduct 100% of business meal expenses where the food or beverages is provided by a restaurant, provided:

- The expense is an ordinary and necessary expense paid or incurred during the taxable year in carrying on any trade or business.

- The expense is not lavish or extravagant under the circumstances.

- The taxpayer, or an employee of the taxpayer, is present at the furnishing of the food or beverages.

- The food and beverages are provided to a current or potential business customer, client, consultant, or similar business contact. Final regulation 1.274-12(b)(3) defines “business associate” as a “person with whom the taxpayer could reasonably expect to engage or deal in the active conduct of the taxpayer’s trade or business such as the taxpayer’s customer, client, supplier, employee, agent, partner, or professional adviser, whether established or prospective.

Educator Expense

The Act specifies that the $250 above-the-line educator expense deduction shall include personal protective equipment (PPE), disinfectant, and other supplies used for the prevention of the spread of COVID-19 effective for expenditures after March 12, 2020.

Unemployment Assistance

All Federal supplemental unemployment insurance benefits, which had already expired or would end on December 31, 2020, will be extended through March 14, 2021. However, the supplemental amount will only be $300 per week instead of the $600 that the CARES Act authorized.

Earned Income Tax Credit (EITC) & Child Tax Credit (CTC)

These credits are based upon earned income. Because families may have had reduced income during 2020 that would adversely affect the amount of these credits, the legislation allows the 2019 earned income to be used to compute the credits for 2020. However, this affects the computation of the EITC and CTC only and does not affect the 2020 gross income for tax purposes. This is temporary for 2020 only.

Cash Charitable Contributions for Non-Itemizers

For 2020, the CARES Act allows non-itemizers to deduct $300 of cash contributions regardless of filing status. The Act of 2020 changes that for 2021 and allows an above-the-line deduction for cash contributions of $600 for joint filers and $300 for all other filing statuses. However, Congress is concerned that taxpayers will abuse this provision and added a 50% underpayment of tax penalty where the contribution cannot be properly documented. Cash Charitable Contributions for Itemizers For 2020 the 60% limit on cash contributions was suspended for 2020, thus allowing larger cash contributions during the COVID crisis. Under the Act the suspension of the 60% limit has been extended to 2021.

Flexible Spending Arrangements Carryover

Under current law cafeteria plans may only permit a carryover of unused amounts remaining in a health FSA as of the end of a plan year in an amount of no more than $550.

The Act extends the carryover period to 12 months after the end of such plan year for unused benefits and contributions to health flexible spending and dependent care flexible spending arrangements for 2020 and 2021.

An employer may also allow an employee who ceases to participate in the plan during calendar year 2020 or 2021 to continue to receive reimbursements from unused benefits or contributions through the end of the plan year in which the employee’s participation ceased, including any extended grace period.

Reduction in Medical Deduction

AGI Floor The medical deduction AGI threshold was scheduled to increase to 10% beginning in 2020. The Act makes the 7.5% threshold permanent.

Volunteer Firefighters and Emergency Medical Responders

Benefits Under prior law, for tax years beginning in 2020, for any member of a “qualified volunteer emergency response organization,” gross income excluded certain state or local tax relief provided for performing volunteer emergency response services or any payments provided by state or local governments on account of performing volunteer emergency response services. The Act makes this exclusion permanent. (IRC 139B as amended by Act Sec. 103).

Education Credits Phaseouts Consolidated

Under prior law the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC) each had a different phaseout range. The Act replaces the dual phaseouts with a single one that applies to both credits. This increases the AGI at which the LLC phaseout begins which allow more individuals to qualify for the LLC. Effective for years after December 31, 2020. The phaseout ranges will not be adjusted for inflation in future years.

| Filing Status |

Phaseout Range |

| Unmarried Filing Status |

$80,000 – $90,000 |

| Joint Filing Status |

$160,000 – $180,000 |

| Married Separate |

No Credit Allowed |

Discharge of Qualified Principal Residence Indebtedness

For several years going back to 2008 taxpayers have been able to exclude from income up $2 Million, $1 Million for Married Filing Separate taxpayers, of home debt forgiveness income from their income. This provision has been previously extended and was scheduled to sunset after 2020. Because so many homeowners are behind in their home mortgage and property tax payments and may lose their homes, the Act extends the provision through 2025 but reduces the maximum exclusion for years after 2020 to $750,000 ($375,000 MFS)

Employer-Provided Educational Assistance

Educational assistance provided under an employer’s qualified educational assistance program, up to an annual maximum of $5,250, is excluded from the employee’s income. The CARES Act expanded the definition of expenses to include employer payments of the employee’s student loan debt. But this special allowance was only available for payments made between March 27, 2020 through December 31, 2020. The Act extends the exclusion for loan repayments made through 2025.

Mortgage Insurance Premiums

For tax years 2007 through 2020 taxpayers could deduct as an itemized deduction the cost of premiums for mortgage insurance paid in connection with acquisition debt on a qualified personal residence. The deductible amount of the premiums phases out ratably by 10% for each $1,000 by which the taxpayer’s AGI exceeds $100,000 (10% for each $500 by which a married separate taxpayer’s AGI exceeds $50,000). If AGI is over $109,000 ($54,500 MFS), the deduction is totally phased out. The Act extends this provision for one year through 2021.

Nonbusiness Energy Credit

Since 2006 taxpayers have been able to claim a credit for making qualifying energy saving improvements to their existing homes. The dollar limits and credit percentages have been modified several times since the credit first became available. The credit of 10% of the amounts paid or incurred by the taxpayer for qualified energy improvements to the building envelope (windows, doors, skylights, and roofs) of principal residences ranges from $50 to $300 for energy-efficient property including furnaces, boilers, biomass stoves, heat pumps, water heaters, central air conditioners, and circulating fans, and is subject to a lifetime cap of $500. The Act extends this credit through 2021.

2-Wheeled Plug-In Electric Vehicle Credit

The Code provides a 10% credit for highway-capable, two-wheeled plug-in electric vehicles (capped at $2,500). Battery capacity within the vehicles must be greater than or equal to 2.5 kilowatt-hours. The Act extends this credit for one year so that it applies to property placed in service through 2021.

Solar (REEP) Tax Credit Phaseout

Under pre-Act law, individual taxpayers were allowed a personal tax credit, known as the residential energy efficient property (REEP) credit, equal to the applicable percentages of expenditures for qualified solar electric property, qualified solar water heating property, qualified fuel cell property, qualified small wind energy property, and qualified geothermal heat pump property. The Act extends the credit phaseout for two years as illustrated in the table.

| SOLAR CREDIT RATE PHASEOUT |

| Applicable Year |

Prior Law |

New Law |

| Thru 2019 |

30% |

30% |

| 2020 |

26% |

26% |

| 2021 |

22% |

26% |

| 2022 |

-0- |

26% |

| 2023 |

-0- |

22% |

| 2024 |

-0- |

-0- |

If you have questions about how this COVID-19 tax legislation might apply in your situation, please give our office a call.